pros and cons list carbon tax

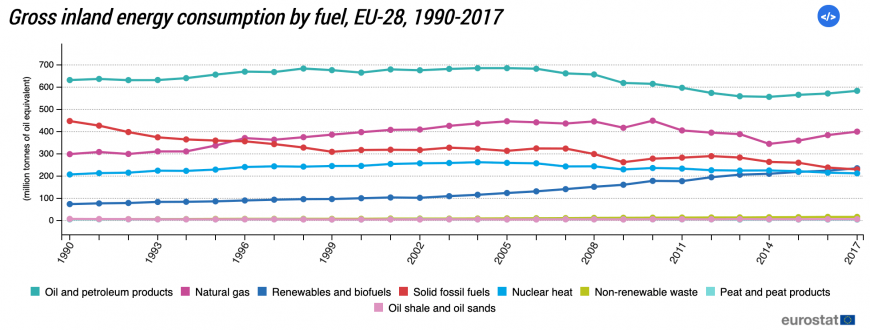

Companies may relocate to. Some countries have already adopted such a tax and discussions are ongoing in others.

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Lower emissions mean cheaper everything allowing for greater profit margins.

. Carbon taxes are adjustable. Encourage use of environmentally friendly fuelsIntroduction of social cost on carbon emission will encourage firms and individuals to look for alternative sources of fuel like solar power in order to avoid high. A much more straightforward plan is simply to tax carbon directly.

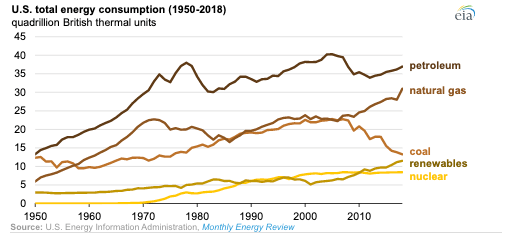

Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax rate by 7 percentage. It removes the arbitraging games and artful dodges that have helped undermine cap and trade schemes in places like Europe but in return it requires that politicians vote for a tax. Many companies cant reduce their emissions as much as theyd like to.

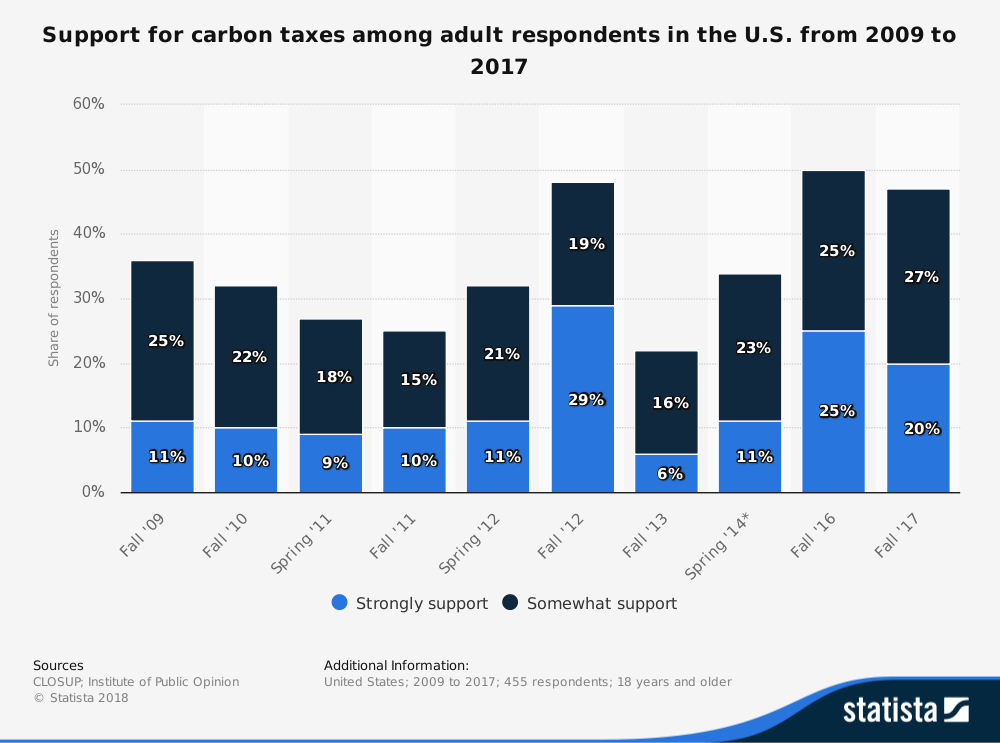

If you give a company or an individual a free hand and dont put any financial burden or accountability then the individual or company will go all guns blazing damaging the environment in the process. But the carbon tax keeps running aground. Carbon Tax Pros Carbon Tax Cons.

List of Advantages of Carbon Tax 1. Up to 24 cash back end it is best to look at its pros and cons. Payment of social cost.

There are additional benefits to be reaped from the implementation of either a carbon tax or CAT system other than just a reduction in emissions. A tax on carbon begun today must last about 40 years. 6 Carbon taxes would put a share potentially a large share of the US.

With the carbon tax causing increases in business overheads companies will be prompted to find more efficient ways to manufacture their products or deliver their services as it would be beneficial to their bottom line. There are three big problems with the concept. The Pros and Cons of Carbon Tax.

Contrary to that the carbon tax has a chance to incentivize emissions even lower than a set goal but there is no guarantee. Carbon taxes produce explicit revenues. High prices for carbon-emitting goods reduce demand for them.

List of Pros of Carbon Tax. By imposing a tax you are making a. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions.

And indeed that they keep voting to raise it year after year. It is easier and quicker for governments to implement. Carbon tax makes companies more responsible.

The proponents claim this would be easy to administrate as there are already special taxes in place in the energy sector that can be used as the foundation to the new carbon tax policy. The revenue could be used to. The Pros and Cons of Taxing Climate Change.

A carbon tax can be very simple. It prompts the environmental polluters to pay an external cost for emission of carbon dioxide in the environment. The voluntary carbon offset credit market has the potential to play a major role in allowing society to continue to emit greenhouse gases while striving to keep global warming under 15 degrees.

It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint. Good for the Environment. A carbon tax also has one key advantage.

The Pros of Carbon Offsetting. Even if as many proponents suggest the. A climate change economist discusses effectiveness of a carbon tax.

Solar panels wind turbines nuclear power plants and electric cars are no longer enough to mitigate the risks posed by human-driven climate change according to University of Illinois economist Don Fullerton. Tax system under the influence of bureaucrat-scientists at the UN who gin up more and more scary scenarios in order to. Thats a long time for a scheme of taxation to go unchallenged in American politics.

Its also giving a group urging Washington to enact a tax on carbon US1 million to advocate for this policy. The downside is that you need to guess how high to. The regressive effects are well known.

Carbon taxes would create new tax revenues and it remains to be seen how that money would be used policymakers would decide. Since the government regulates how much emissions are allowed emissions will never rise past their cap. It encourages people to find alternative resources.

Know the pros and cons Economists argue that in theory taxing the companies that produce fossil fuels or the consumers who buy their products or perhaps both should curb the supply of and demand for oil gas and coal. The tax could be used to subsidize lower-income people who might have trouble paying energy costs. If the policy were to be enacted a large percentage of a countrys carbon emissions will be monitored and sanctioned.

A carbon tax reflecting the social cost of carbon is viewed as an essential policy tool to limit carbon emissions. The business community would not accept the impact on energy costs. Instituting a carbon tax could help reduce the deficit and produce incremental benefits for the environment but could also raise the cost of many.

Carbon offsetting has benefits at both ends of the process. Carbon Tax - The revenue that a carbon tax generates can be used to encourage investment in more renewable energy projects by offering subsidies to companies who build low or no-carbon plants. The carbon tax is generally levied on fossil fuels.

It would disproportionately hurt low-income consumers it would inevitably be watered down by special interests and it would have to be imposed on our trading partners. Also carbon taxes provide a broader scope in terms of emission. Keith Orchison says a carbon tax on fossil fuels is unlikely.

A carbon tax is a simpler blunter tool which is easier to administer and regulate.

Pros And Cons Of Each Regional Economic Model Type For Estimating Download Scientific Diagram

Pros And Cons Of Each Regional Economic Model Type For Estimating Download Scientific Diagram

Carbon Tax Pros And Cons Economics Help

Carbon Tax Pros And Cons Economics Help

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

Infographic On Geothermal Energy Pros And Cons Best Pick Reports Geothermal Energy Geothermal Energy

Carbon Tax Pros And Cons Economics Help

Carbon Tax What Are The Pros And Cons Climateaction

Summary Of Qualitative Assessment Major Pros And Cons Of Different Download Table

What Are The Pros And Cons Of A Carbon Tax Elawtalk Com

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

27 Main Pros Cons Of Carbon Taxes E C

The 3 Biggest Advantages Of Renewable Energy And The Cons

Pros And Cons Of Fossil Fuels Why Can Fossil Fuels Be Good

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

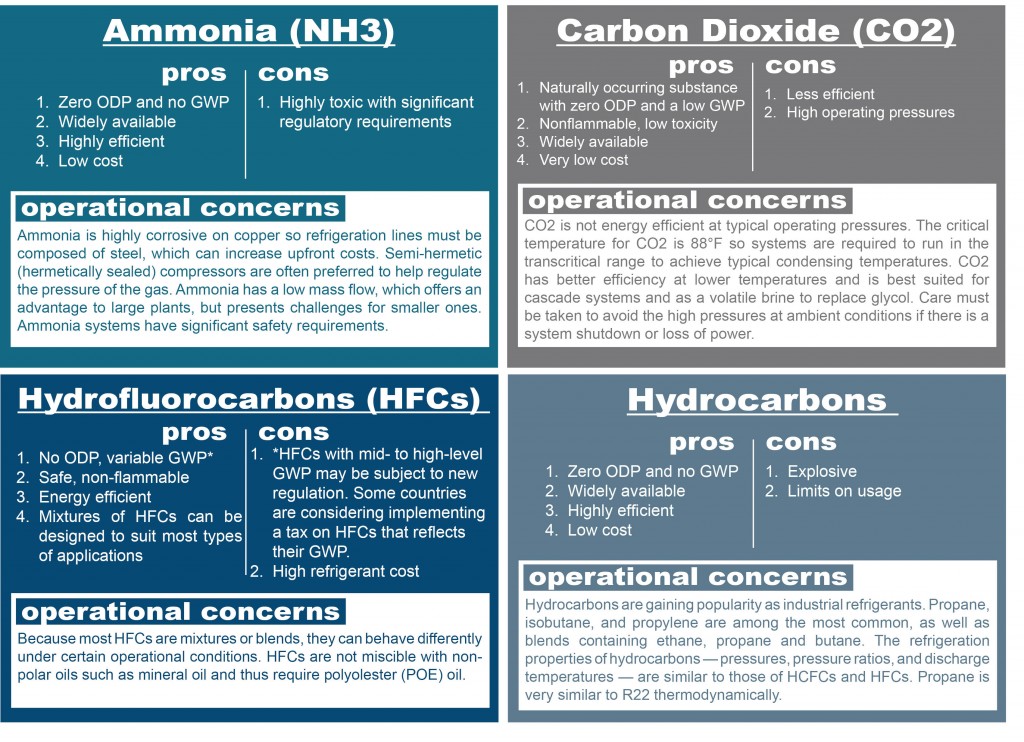

Industrial Refrigerants Selection Guide From Stellar Stellar Food For Thought